Tennessee Patient Sentiment toward Non-Medical Drug Switching

In an attempt to reduce their own bottom lines, pharmacy benefit managers and health insurers are increasingly making coverage changes aimed at forcing patients that are stable on their current therapies to switch to cheaper treatment options. These lower-cost options may be therapies that patients have already tried and failed on, or are options their physicians have not personally recommended for them based on their unique medical histories.

This is known as “non-medical switching.” It erodes patient health and drives up long-term monetary and societal costs.

There are currently no protections preventing commercial health insurers from reducing prescription coverage at any time during the year, even including right after a consumer has signed on to a plan. These prescription coverage changes may take the form of increased out-of-pocket costs, more restrictions around access, or removing medications from coverage entirely.

Background

Although formularies and other utilization management techniques may help contain costs for third-party payers, potential savings often come at the expense of patients’ health.

One major example is non-medical switching, which occurs when a health plan’s formulary changes in a way that monetarily pressures patients to cease filling their prescribed medication in lieu of a “preferred” or cheaper drug. Non-medical switching can occur during the health plan year. Formulary changes may include:

- Completely removing a patient’s medication from the formulary;

- Increasing the patient’s out-of-pocket costs;

- Changing the tier of the patient’s drug or adding new restrictions on the medication.

Formulary changes can happen at any time. Insurers are free to change formulary coverage however they wish, whenever they wish. Changes often occur mid-year and it is important to understand that patients can’t renegotiate their contracts mid-plan and have no choice but to stay with the plan. Essentially, patients are not being provided with the benefits that were marketed to them during the open enrollment period.

Whatever form it takes and whenever it occurs, non-medical switching can be very harmful to patients. As a result of being switched from their original, clinician-prescribed medication, patients may experience additional side effects, symptoms, disease progression, and potentially relapse. Beyond the immeasurable impact of this unnecessary suffering, the negative effects of non-medical switching can result in additional medical appointments, emergency room visits and even hospitalization, thereby actually increasing overall healthcare utilization costs.

Despite this, the impact of non-medical switching on patients has been remarkably unmeasured and ignored by health insurance companies. In order to better understand how Tennessee patients are affected by this harmful utilization management technique, Global Healthy Living Foundation (www.ghlf.org) conducted a survey of Tennessee residents living with chronic diseases. The survey’s aim was two-fold in measuring:

- The prevalence of Tennessee residents who are living with chronic diseases being pressured to switch from their clinician-prescribed medicine for non-medical reasons; and

- The adverse physical, mental, emotional and productivity impact of non-medical switching.

Methodology

In February 2016, GHLF partnered with the Tennessee Patient Stability Coalition, which consists of eight diverse patient and clinician advocacy organizations representing hundreds of thousands Tennesseans living with chronic illness and their care providers.

GHLF and the Patient Stability Coalition invited Tennessean residents living with a chronic or rare illness to complete an online, 84-item survey that investigated patient experiences with the manipulation of their respective health plans’ formularies. In order to complete the survey, eligible respondents had to be:

- Diagnosed by a physician with a chronic or rare disease; and

- Currently living in Tennessee

Prospective respondents who did not meet these two eligibility criteria were prevented from completing the survey.

Executive Summary of Results

A statistically significant group of 85 Tennessee residents diagnosed with chronic or rare diseases completed the survey. Although respondent’s individual diseases varied widely, five separate major classes were represented:

- autoimmune (49%)

- infectious (18%)

- mental health (12%)

- neurological (6%)

- oncological (2%)

- other (13%).

A majority of respondents were female (72%), of this female group, 80 percent were white and 8 percent were black. Respondents were either fully employed (27%) or not employed due to disability (36%). The educational attainment of the respondents was about evenly divided between those with less than four years of college (56%) and those with more than four years of college (40%) and the median income reported was $35,000 (+/- $30,000). Most importantly, all types of insurance coverage were represented in our surveyed population: private insurance (52%), public insurance (34%), and dual-public/private type (14%). Thus, based on these demographics, the survey sampled a diverse, representative cross-section of Tennessee’s chronic disease patients.

How many patients does non-medical switching negatively impact?

Astonishingly, results of the survey show that nearly three out of five (58%) respondents have had their insurance company make changes to their health plan’s formulary that reduced coverage of their prescribed medication. The reduction in coverage was so dramatic that the primary therapy they were using to control the symptoms and progression of their disease became suddenly and significantly more expensive. Interestingly, Tennessee patients were 2.4 to 16.7 times more likely to have their coverage reduced on medications for autoimmune disorders than on medications for any other condition class.

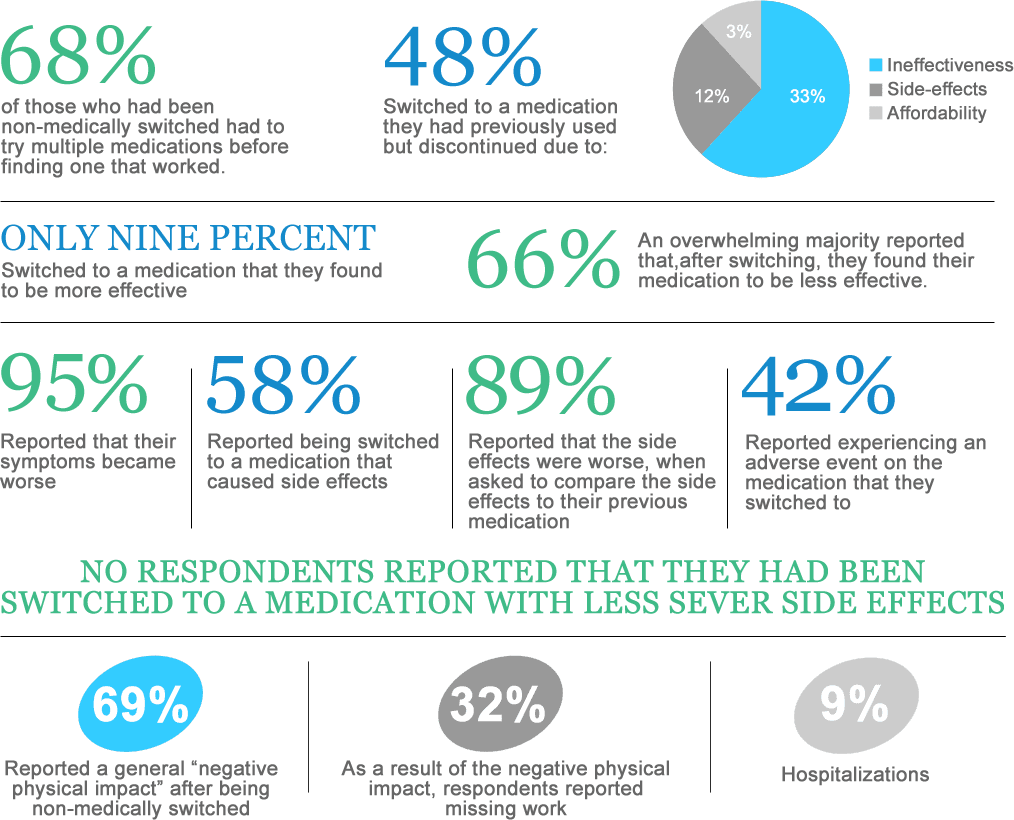

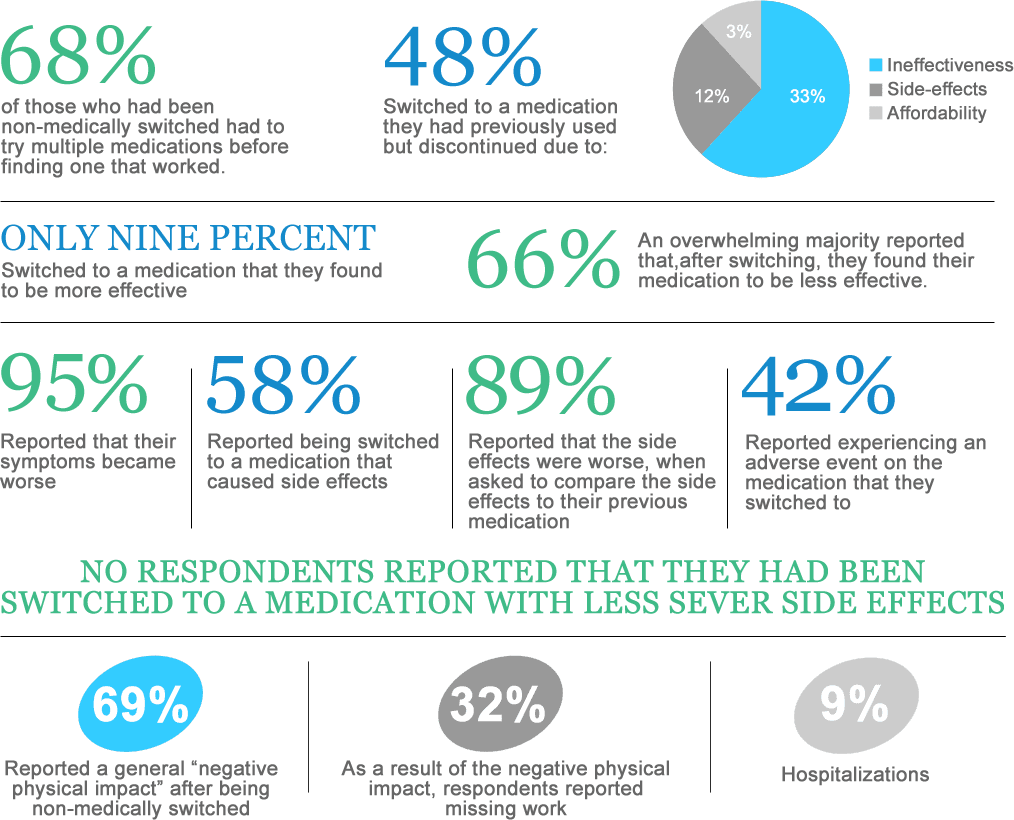

Most significantly, more than two-thirds of our respondents (67%) were unable to afford the increase in out-of-pocket prices and were forced to switch to an entirely different medication. Overall, effectively, 40% of our survey respondents reported being financially coerced by their insurance companies to change their clinician-prescribed medication for non-medical reasons. Additionally, when faced with a loss of coverage to their currently prescribed medication, nearly half of our respondents (49%) reported that their ability to access or obtain their prescribed medication was subsequently delayed.

How does non-medical switching impact patient’s treatment and health?

Nearly all respondents (95%) reported that their symptoms became worse when changes to their formulary delayed access to their prescribed medication. As a direct consequence of being unable to access their medication, 39% reported having to miss work, and 22% reported having to be hospitalized.

Do insurers properly communicate formulary changes to patients?

When investigating communications by third-party payers to inform patients about formulary changes, our survey found almost half (44%) of all respondents reported never receiving any notifications (letters, emails, or phone calls) detailing their plan’s formulary or changes being made to it.

When respondents experienced alterations to their plan’s formulary, slightly less than half (48%) reported their insurance company informed them of the altered coverage to their prescribed medication. A majority of respondents (52%) were informed second-hand by their pharmacist (32%) or physician (21%). Furthermore, when respondents reported experiencing alterations that decreased coverage for prescribed medication, only 28% reported that their insurer was transparent that the changes were being made primarily for cost concerns.

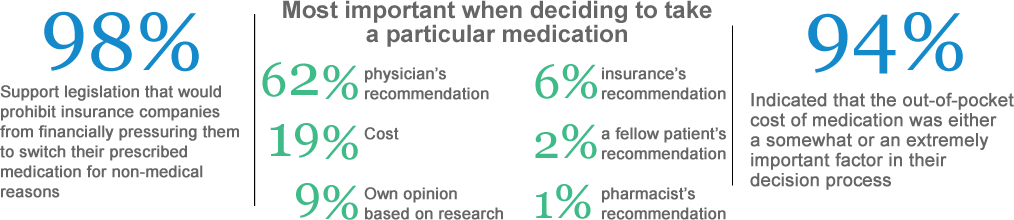

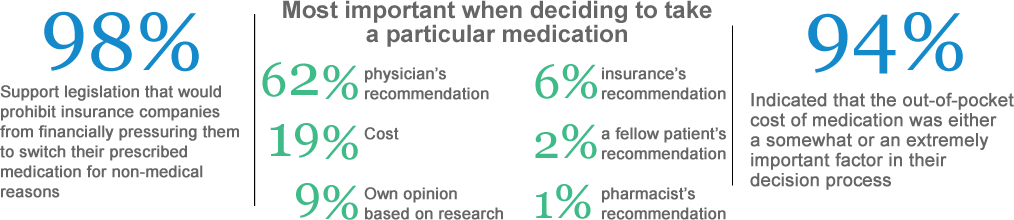

How do patients feel about non-medical switching?

Conclusions and Recommended Policy Action

Our survey has shown non-medical switching is a prevalent and growing practice in Tennessee. It can put patients who have complex, chronic, or rare diseases at severe risk, and disproportionately affects patients of lower means (i.e. lower socioeconomic status). Multiple switches can either force patients onto less effective and more dangerous medications or eliminate treatment options for patients in a disease state that has a limited bank of therapies. Health Insurance Company utilization management techniques, such as reductions in drug coverage, result in treatment gaps and cessation of effective therapy, therapy that often takes years to find. As a result of associated increases in side effects and adverse reactions that can lead to hospitalization, more doctors’ appointments, emergency room visits, and so on, non-medical switching can actually increase overall utilization costs.

Currently, there are no state protections for patients in Tennessee. Tennessee needs legislation to ensure that insurers honor their contracts with patients in order to ultimately protect the health of patients.

Legislation should consist of patient protections that ensure that outside of open enrollment periods, a health insurance entity providing commercial health insurance coverage for prescription drugs shall not:

- Remove any covered prescription drug from its list of covered drugs during the health plan year unless the United States Food and Drug Administration (FDA) has issued a statement about the drug that calls into question the clinical safety of the drug, or the manufacturer of the drug has notified the FDA of any manufacturing discontinuance or potential discontinuance as required by s.506C of the Federal Food Drug and Cosmetic Act, 21 U.S.C. s 356c;

- Reclassify a drug to a more restrictive drug tier or move a drug to a higher cost-sharing tier during the health plan year unless a generic equivalent product becomes available; or

- Reduce the maximum coverage of prescription drug benefits.